michigan sales tax exemption for farmers

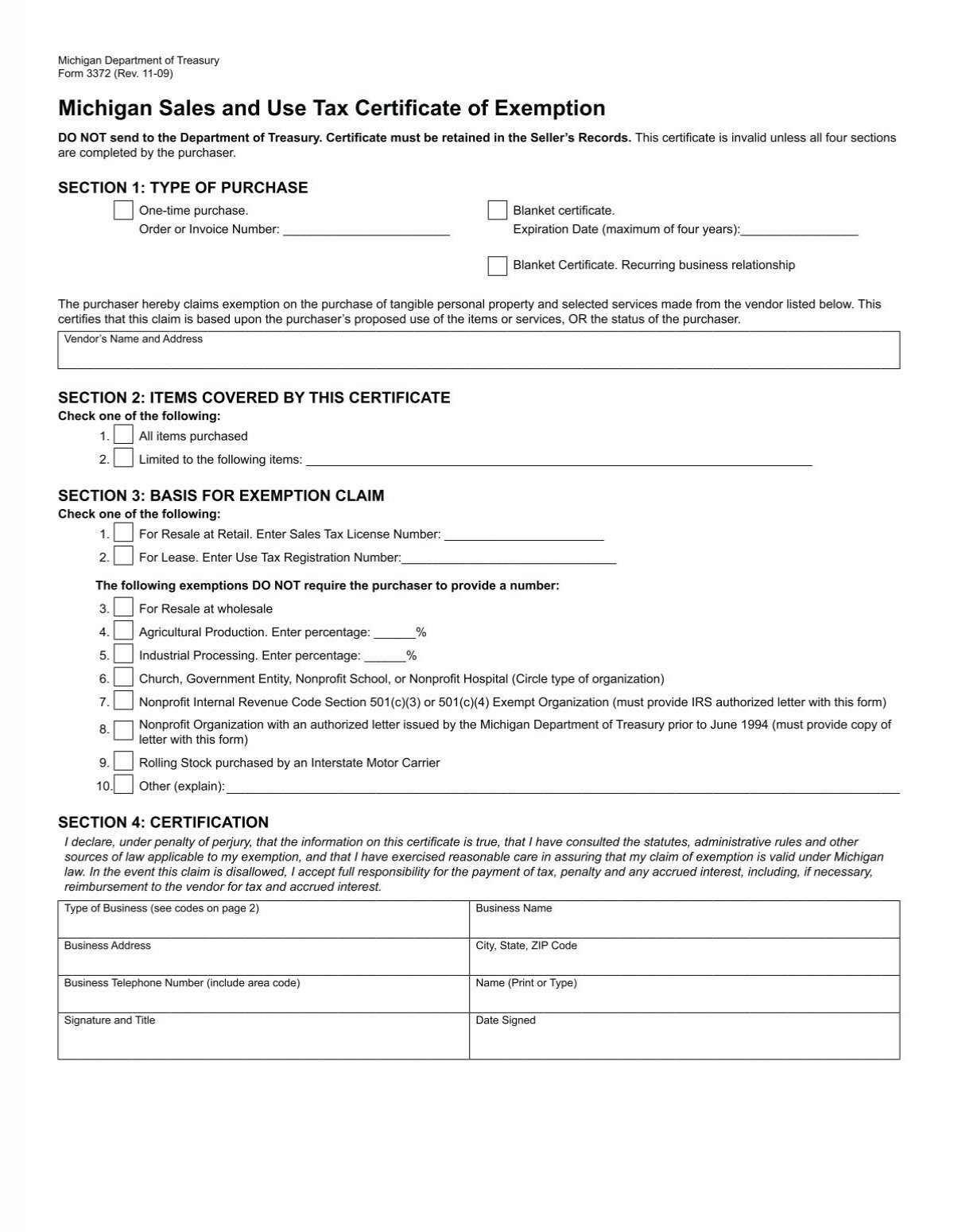

Michigan Department of Treasury Form 3372 Rev. Producers will note on item 4 in section 3 that you are to indicate the percentage of the purchase item is for agricultural production and that percentage would be exempt from sales tax.

You should never use your social security number for retail purchases.

. Exemption promulgated under the Michigan Use Tax Act. Development of legislation allowing landowners to voluntarily enroll in a program that reduces assessments on farm buildings by up to 100 percent of their current taxable value and assesses farmland. The CohnReznick State and Local Tax team is working diligently to identify state tax.

Sales Tax Exemptions in Michigan In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Sales tax exemption on ORV needing form 3372 C3 or form C4 to justify the use off farm by completing form 3372 Michigan Sales and Use. Sales tax exemption for farmers michigan state university extension applies research from msu to help michigan residents solve everyday problems in agriculture munity development nutrition state and local sales tax information taxjar individual state and local sales tax information provided by taxjar state sales tax list by state taxman123 the sales tax charged.

Instructions for completing Michigan Sales and Use Tax Certicate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualied transactions. 10 million acres of agricultural land in Michigan contain 56000 farms which produce 57 billion in products annually. The use tax exemption applies only on diesel and aircraft fuel purchases made on or after March 6 2006 and biodiesel fuel purchases made on or after May 11 2007.

Specifically Respondent assessed Michigan use tax on the purchase price of truck scales storageprocessing tanks storage tank inventory monitoring equipment a liquid storage tank a personnel elevator and other equipment used in the feed mill operation. In the state of Michigan sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Both of these documents are required to be completed for the retailer selling the materials to the contractor to keep in their files.

To claim exemption from Michigan sales or use tax that contractor must provide a completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption and provide a copy of Form 3520 that you received from your customer. What transactions are generally subject to sales tax in Michigan. There is no such thing as a Sales Tax Exemption Number for agriculture.

Several examples of exceptions to this tax are vehicles which are sold specifically to relatives of the seller certain types of equipment which. 20 Congress voted to pass a sweeping tax reform bill that wont change Franklins sage guarantee but does seem certain to lower federal taxes paid by most farmers and ranchers. Farmers across the state can breathe a little easier after Lieutenant Governor Brian Calley signed into law legislation to protect agricultures sales and use tax exemptions and put an end to misinterpretations by the Department of Treasury.

The Tax Cuts and Jobs Act HR. The certificate that qualifying agricultural producers organizations and other exempt entities may use is the Michigan Sales and Use Tax Certificate of Exemption or form 3372. Steps for filling out the Michigan Sales and Use Tax Certificate Exemption Form 3372 Step 1 Begin by downloading the Michigan Resale Certificate Form 3372 Step 2 Indicate whether the transaction is a one-time purchase or a blanket certificate.

Michigan farm tax exempt form. State and local tax issues however have received very little attention. There are no local sales taxes in the state of Michigan.

All claims are subject to audit. Producers will note on item 4 in section 3 that you are to indicate the percentage of the purchase item is for agricultural production and that percentage would be exempt from sales tax. The state of Michigan levies a 6 state sales tax on the retail sale lease or rental of most goods and some services.

Provides a sales and use tax exemption for farm products sold at farmers markets. Retailers Retailers purchasing for resale should provide a signed exemption certificate by completing form 3372 Michigan Sales and Use Tax Certificate of Exemption and check box 1. Farms are defined as any place from which 1000 or more of agricultural products were produced and sold or normally would have been sold during the census year.

Much has been written about Section 280E of the Internal Revenue Code and how it impacts the cannabis industry. If the retailer is expected to be purchasing items frequently from the seller instead of completing a resale. These farms and other lands eligible for favorable treatment under certain legislation can take advantage of real property tax relief and transfer emptions under the General Property Tax Act MCL 2111 et seq.

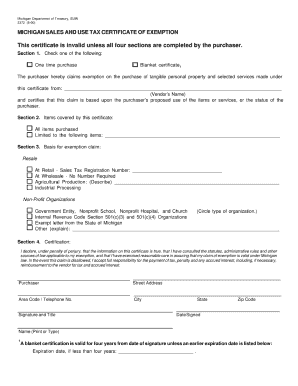

It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. 7-08 Michigan Sales and Use Tax Certificate of Exemption DO NOT send io the Department of. Agricultural property in Michigan is taxed at 50 percent above the national average which is a significant cost.

The certificate that qualifying agricultural producers organizations and other exempt entities may use is the Michigan Sales and Use Tax Certificate of Exemption or form 3372. Httpwwwmichigangovdocumentstaxes3372_216612_7pdf Producers will note on item 4 in section 3 that you are to indicate the percentage of the purchase item is for. Lowering agricultural property taxes in Michigan.

Use tax is also collected on the consumption use or storage of goods in Michigan if sales tax was not paid on the purchase of the goods. Their sales tax license number must be included in the blank provided on the exemption claim. And Farmland and Open.

The use tax rate is the same as. Several examples of exemptions to the states sales tax are vehicles which have been sold to a relative of the seller certain types of equipment which is used in the agricultural business or some types of industrial machinery. Agricultural The certificate that qualifying agricultural producers organizations and other exempt entities may use is the Michigan Sales and Use Tax Certificate of Exemption or form 3372.

1 will deliver modest tax reductions for W-2 earners in the form of modified individual tax brackets which are included. Agricultural Sales Tax Exemption and Medical Marijuana. The certificate that qualifying producers organizations and other exempt entities may use is the Michigan Sales and Use Tax Certificate of Exemption or form 3372 found at website.

Include a completed Farmers Certificate for Wholesale Purchases and Sales Tax Exemptions with your fuel tax refund request to avoid having use tax deducted from your refund. January 15 2022Uncategorised. The exemption does not apply to farm products sold by persons or entities with sales of at least 25000 from participating in farmers markets.

Michigan Sales Tax And Farm Exemption MSU Extension. Strongly supported by Michigan Farm Bureau MFB House Bills 4561 and 4564 are now officially Public Acts 113 - 114 of 2018. For Resale at Retail in Section 3 Basis for Exemption Claim.

Producers will note on item 4 in section 3 that you are to indicate the percentage of the purchase.

Sales And Use Tax Regulations Article 3

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

2021 Form Mi Dot 3372 Fill Online Printable Fillable Blank Pdffiller

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Mi Sales Tax Exemption Form Animart

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

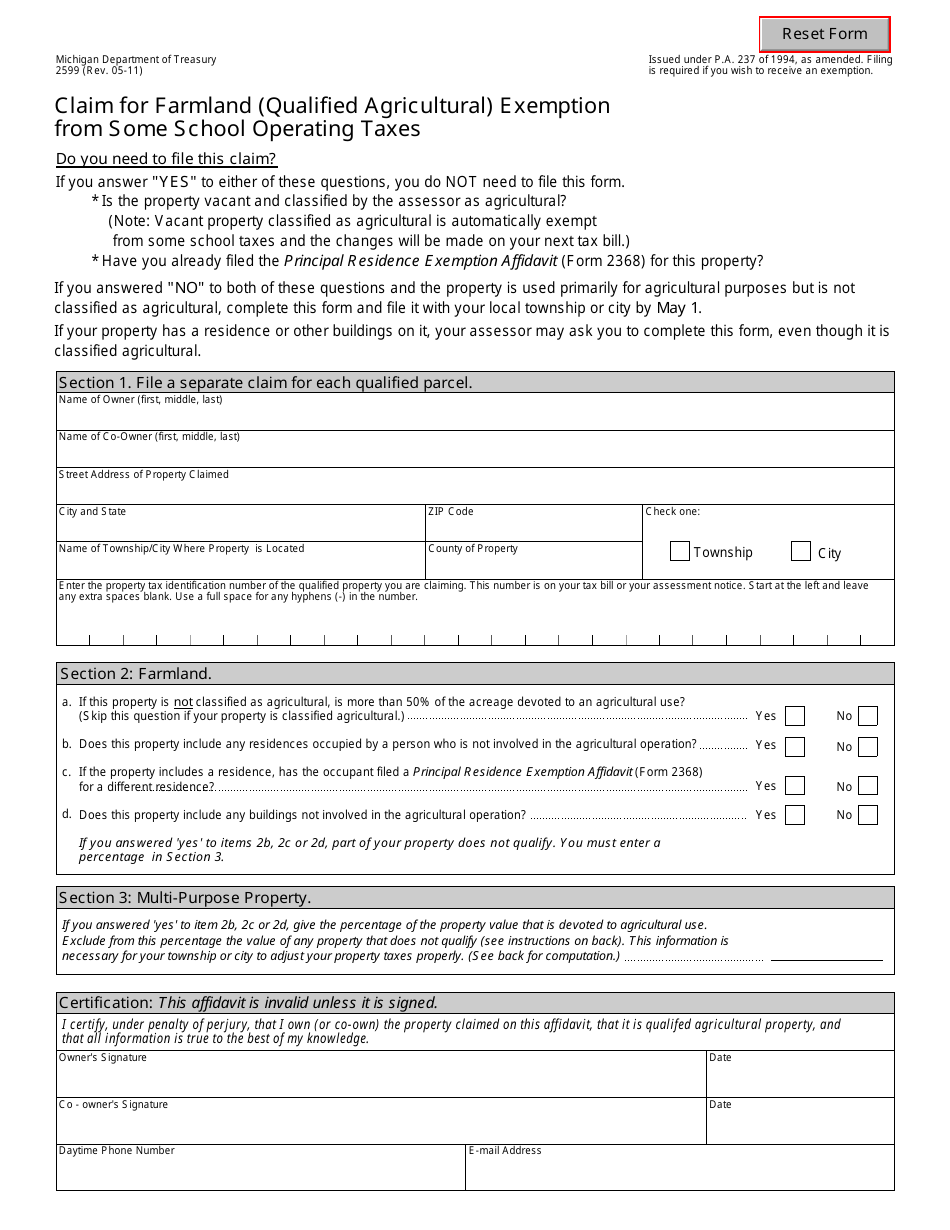

Form 2599 Download Fillable Pdf Or Fill Online Claim For Farmland Qualified Agricultural Exemption From Some School Operating Taxes Michigan Templateroller

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

What To Expect When Applying For An Ag Sales Tax Exemption Permit Morning Ag Clips

Michigan Sales And Use Tax Certificate Of Exemption

Fillable Online Finserv Uchicago Michigan Form 3372 Tax Fax Email Print Pdffiller